Securing funding is essential for any startup’s success. Angel investors, who are wealthy individuals willing to invest in new businesses in return for equity or convertible debt, play a vital role in supporting these emerging companies. This guide will detail the process of locating and engaging with angel investors to either start or expand your business.

Table of Contents

Understanding Angel Investors

What is an Angel Investor?

Angel investors are typically high-net-worth individuals who offer financial backing for small startups or entrepreneurs, often in exchange for equity in the company. Unlike venture capitalists, angel investors provide funding at the early stages of a business and are willing to take bigger risks for potentially higher returns.

Why Choose Angel Investors?

- Flexibility in Funding: Angel investors are more flexible about their investment terms compared to traditional lenders.

- Mentorship and Expertise: They often provide valuable guidance and access to their network of contacts.

- Faster Funding Process: The process is generally quicker than securing venture capital.

Mapping the Guide

| Pitch Preparation | Develop a clear pitch deck highlighting your business model, market potential, team strengths, and financial needs. Include solid financial projections and a robust business plan to show preparedness. |

| Finding Angel Investors | Engage in networking at industry events, utilize platforms like AngelList, and leverage professional referrals to connect with potential investors. Research their investment history to ensure alignment. |

| Engagement Strategies | Initiate contact with a personalized email summarizing your value proposition. Prepare concise pitches and maintain transparency during discussions. Follow up promptly after meetings. |

| Securing the Investment | Clearly negotiate the terms of investment, focusing on equity shares and roles. Ensure legal agreements are vetted by a qualified attorney to avoid future complications. |

| Investor Relations Management | Regularly update investors about business progress and significant changes. Seek advice and use their network for business growth. Address issues early and keep investors informed. |

Preparing Your Pitch

Your pitch deck is your first opportunity to make a strong impression on potential investors. It should succinctly present:

- Introduction to Your Business: Clearly describe what your business does and the problem it solves.

- Market Analysis: Provide data on your target market and competitive analysis.

- Business Model: Explain how your business will make money.

- Financials: Include past and projected financials.

- The Team: Highlight the experience and skills of your team members.

- The Ask: Specify how much money you need and how it will be used.

Importance of a Business Plan

A detailed business plan supports your pitch by demonstrating your serious commitment and thorough preparation. It should outline your business strategy, key objectives, and how you intend to achieve them.

Identifying Potential Angel Investors

Finding the Right Investors

- Networking: Attend industry conferences, seminars, and startup meetups.

- Angel Networks: Join platforms such as AngelList, Gust, and local angel networks.

- Referrals: Use your professional network to get introductions to potential investors.

Research Your Prospects

Understand the investment history and interests of potential investors to ensure they align with your startup’s vision and goals.

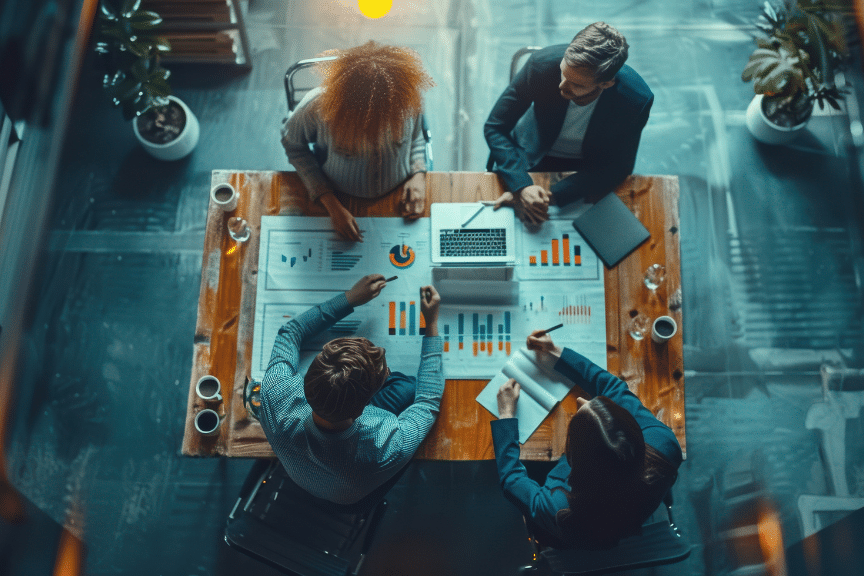

Engaging with Angel Investors

Initial Contact

- Personalized Emails: Send personalized emails to introduce your startup and summarize your value proposition.

- Elevator Pitch: Be ready to explain your business succinctly at any opportunity.

Meeting Investors

- Be Prepared: Know your business inside out.

- Be Transparent: Honest discussions about risks and challenges build trust.

- Follow-Up: Send a thank you note and respond promptly to any follow-up questions.

Securing the Investment

Negotiating Terms

Discuss the investment terms clearly and ensure both parties are on the same page regarding equity shares, roles, and expectations.

Legal Considerations

Ensure a lawyer reviews all agreements experienced in startup financing to avoid future complications.

Maintaining Investor Relationships

Regular Updates

Keep your investors informed about your progress and any significant changes in your business.

Leveraging Investor Expertise

Don’t hesitate to seek advice and introductions from your investors, as their experience and networks can be invaluable.

Handling Issues

Address any problems early, and keep your investors aware of how you are managing them.

Optimizing Startup Costs with Cloudvisor

Cloudvisor, as an AWS reseller, provides an excellent opportunity for startups to manage their operational costs effectively. By utilizing AWS credits offered through Cloudvisor, your startup can significantly reduce its cloud computing expenses. Showcasing this proactive approach to cost management in your pitch can illustrate to angel investors that you are committed to efficiency and strategic financial planning, making your startup a more attractive investment opportunity.

Conclusion

Finding the right angel investors can be a game-changer for your startup. By understanding what angel investors are looking for and preparing a compelling pitch, you can increase your chances of securing the necessary funds to propel your business forward. Remember, the relationship with your investors is paramount; keep them engaged and informed through the ups and downs of your business journey.